The wellbeing of your workforce is crucial in industries where long hours, physical demands of the job and stress can have a significant impact on their health. We offer employer and employee-paid insurance options that may help to bridge the sick pay gap. Personal Group is the only employee benefits provider delivering financial and wellbeing benefits through face-to-face engagement, alongside our market-leading app-based platform Hapi.

What Makes Us Different

Personalised delivery

We're experts in bringing employee benefits to life.

Our unique approach involves in person delivery of your benefits package and insurance plans by our field engagement team to your employees.

Tailored and consultative

With an initial no-obligation complementary market review, we can provide quotes and recommend the best group insurance cover for your people.

Unlike other brokers, all fees are set for an annual duration, eliminating the need for extra charges related to claims mediation, underwriting and claims tracking support, or text review.

This sets us apart as truly unique in the market.

Benefits and engagement

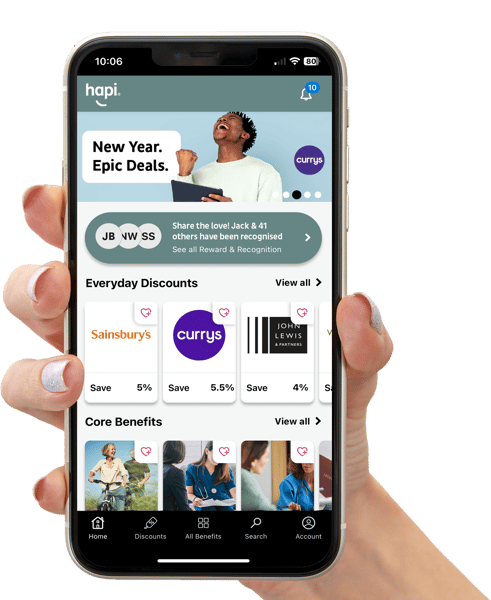

Streamline all your benefits in one place using Hapi – our mobile-first platform. With Hapi you can bring together all your benefits, reward, recognition and communications; to boost wellness, engagement, increase productivity and improve retention.

Already have a benefits platform? You can still bolt on Personal Group Insurance and use our field engagement team with your existing provider.

Established and dependable

Personal Group Holdings, is publicly listed and our insurance business is authorised by the Financial Conduct Authority (FCA).

Over the years, we have provided simple, affordable insurance plans to support frontline workers with limited or no sick pay provision.

Now, our portfolio has grown to include the UK's leading independent pay and reward consultancy, a home technology division, and a wellness and fitness app endorsed by Dame Kelly Holmes.

Plans At A Glance

Employee Paid Cash Plans

Provide your employees and their loved ones with peace of mind if the unexpected happens - all for the price of a cup of coffee a week. It’s a valuable safety net that comes at no cost to you. With no medical required and pre-existing conditions covered, we can offer protection for those often excluded by traditional insurance offerings.

Hospital Plan

Our insurance covers lost income due to outpatient appointments, hospital stays, and pre-existing conditions. From Day 1, it's valid worldwide, so you can concentrate on the important stuff.

- Lost income due to time spent in hospital

- Pre-existing conditions covered

- Amend and cease cover without penalties

- Valid from Day 1 qualifying period (day one value)

- Use worldwide with 760 nights covered.

Recovery Plan

Employees can claim payments during recovery following a successful claim from the Hospital Plan – meaning your recovery period is stress-free.

- Available from first day following inpatient hospital treatment or day-patient surgery

- Pre-existing conditions covered immediately

- For every 6 months claim free, a further 7 days is added to claims entitlement

-

Pregnancy and childbirth covered 10 months from the start date of the employee policy.

Death Benefit

Also known as a Funeral Plan, this pays out a lump sum in the event of death, no matter the cause ensuring funeral expenses and breathing space for loved ones should the worst happen.

- Additional payout for accidental death

- Death from pre-existing conditions (after the plan has been held for 12 months)

- Terminal illness cover

- Anywhere in the world

- Available for employees and their families.

Employer Paid Cash Plans

Elevate your employees' wellbeing with our Employer Paid Cash Plan, simplifying health coverage by addressing basic everyday expenses. We prioritise accessibility and simplicity. Opting for this plan not only supports your workforce's health but also brings financial advantages, benefiting from reduced benefit platform fees. At Personal Group, we redefine cash plans, offering comprehensive coverage with unparalleled ease.

Group Insurance

We provide an array of insurance options including life insurance, Private Medical Insurance, Critical Illness Cover, gap insurance protection, travel insurance, and health assessments. These plans, whether voluntary or employer-paid, offer a simple and affordable solution for common healthcare needs. Additionally, access exclusive reduced rates and discounts on consumer insurance for pets, gadgets, cycles, and travel. Personal Group ensures that your organisation's insurance needs are not just met but exceeded, setting a new standard in employee wellbeing.

Dental Care

Effectively manage and distribute the expenses associated with routine health and restorative dental care. Unlike other providers, we conduct a comprehensive market review to ensure the best coverage.

Cash Plans

Simplify and make healthcare coverage affordable with our straightforward plans, offering a cost-effective solution for addressing common health issues.

Consumer Insurance

Benefit from exclusive reduced rates and discounts on travel, car, bicycle, gadgets and pet insurance. Safeguard your adventures, drive with confidence, and cherish moments with your furry friends – all at prices designed to fit your budget.

Our Mobile-first Employee Engagement Platform

Accessible through Hapi, our market-leading, mobile-first benefits platform and uniquely presented to your colleagues by our team of Employee Engagement Executives. Our products go beyond mere insurance.

Discounts

Savings at 100s of shops, supermarkets

and days out

Wellbeing

Supporting physical, mental, financial and social wellbeing

Recognition

Reward employees who embody your company values

Salary Sacrifice

Wage exchange benefits include health plans, cars and technology

Trusted By...