Smart, Simple Insurance Plans on Hapi

Give your employees access to meaningful protection for less than the cost of a weekly coffee - while strengthening your organisation’s reputation as a caring, supportive employer.

With Hapi, you can provide access to hospital, recovery, and death benefit insurance plans that can help provide peace of mind for your people — and it doesn’t cost your business a thing.

Why businesses offer insurance through Hapi:

✓ Enhance your EVP with benefits only available from you

✓ Build loyalty and engagement - prove that you’ve got their back

✓ Help protect your people through accessible insurance plans

Want to know more?

A powerful add-on to your people strategy

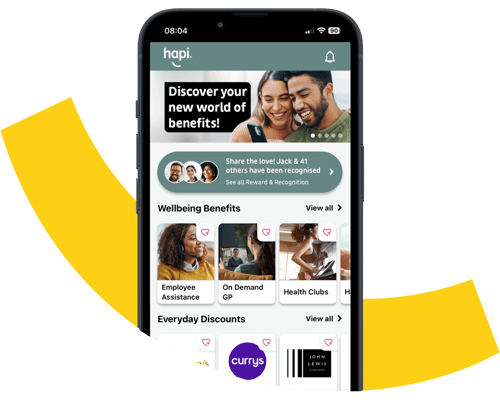

Looking after your employees has never been easier or more impactful. Hapi lets you customise your employee engagement platform with the tools your workforce needs to thrive: from wellbeing and insurance to benefits, rewards and recognition - all in one seamless experience.

Trusted by over 100,000 workers across the UK

“Personal Group’s cash plans have become a trusted resource for our team, providing them with real, everyday security that they know they can rely on. It’s something we’re proud to offer our workforce. With Personal Group’s impressive 95% claim payout rate, our employees feel confident that they’ll be supported when they need it.”

Frank Kenwright, Head of Payroll at Merseyrail

Why employers must act in 2025:

£103 billion

The cost of employee sickness has risen over £30bn since 2018.

Source: Institute for Public Policy Research 2024

36%

of employees have taken time off work due to money worries.

Source: Bippit 2024

83%

say they’d stay longer with better financial wellbeing support.

Source: Trinity McQueen research for Close Brothers “Spotlight on UK financial wellbeing” report 2023.

Meet Hapi

Hapi is the all-in-one platform that simplifies employee benefits, engagement, and communication. It centralises benefits, making them easier to manage while boosting employee participation. With customisable perks, rewards & recognition, financial wellbeing support, and real-time insights, Hapi helps HR teams streamline admin and maximise the impact of their benefits strategy.

Why does employee insurance matter?

Life is unpredictable, but your employees shouldn’t face it alone. Our insurance plans offer your employees a vital safety net, covering hospital stays, recovery periods following hospital inpatient treatment, and providing cash lumps should the worst happen - giving families one less thing to worry about during difficult times.

It’s practical, personal protection that reinforces your culture of care and adds lasting value to your employee experience.

Why Choose Hapi? Simple, Accessible Employee Insurance

Our employee paid cash plans can provide your teams and their families with additional financial support during hospital stays or periods of absence from work following hospital inpatient treatment. They’re designed to help bridge the sick pay gap - at no extra cost to your business.

Our Insurance Plans cover:

Hospital Plan

Provides payments for outpatient appointments, day surgery and overnight stays in hospital.

Recovery Plan

Provides financial support during recovery from overnight hospital stays or day surgery.

Death Plan

Pays out a lump sum in the event of death from any illness or injury, no matter what the cause.

Group Cash Plan

Employer-funded plan covering everyday healthcare costs (e.g. dental, physio) with options for employees to boost cover.

Award-winning

benefits platform

We’ve won Best Use of Technology for Benefits twice - proof that Hapi makes employee benefits smarter, simpler, and more engaging. Our secret? Innovative tools and insights that solve real-world challenges, boost engagement, and elevate your benefits game.

Tackle any HR challenge with these 5 guides

Download any (or all) of them – no fluff, just real HR solutions that work.

How Future-Ready Is Your Employee Benefits Strategy?

Take this short quiz to assess your current benefits approach and discover how you can improve recruitment, retention, engagement and more.